ny estate tax exemption 2022

For previous periods see information for dates of death on or after February 1 2000 and before April 1 2014. New York has an estate tax exemption of 5930000 for 2021.

2016 New York State Estate Tax Update Burner Law Group

This means that a New Yorker passing away with more than the exemption amount or a non NY resident with tangible or real property in NY in excess of the exemption must pay a.

. It means that if a New York resident passes away having an estate of 5930000 in 2021 100 of the legacy will pass to the heirs without any New York state tax due. New York Estate Tax Exemption 2022 New York estate tax laws have changed significantly over the past few years and continually change every year. According to the Tax Cut and Jobs Act the federal tax exemption for 2022 is 1206 million per person or 2412 million for married couples.

What is the current exemption from New York estate tax again. This change in tax law means that wealthy individuals estates can be protected from the claw of federal law through a 10 estate tax exemption. We previously announced that the 2022-2023 STAR exemption maximum savings are also available online.

The indexed amount is 1206 million for people who pass away in 2022. If someone dies in September 2022 leaving a taxable estate of 7 million the estate would exceed the New York exempt amount 6110000 by 890000. Various methods including traditional bypass trust can be utilized to either reduce or avoid liability.

New York State does not recognize portability so unlike federal law which enables a surviving spouse to make use of the deceased spouses unused estate tax exemption New York law requires some extra planning. No NYS gift tax. The table below can help illustrate the impact of the NY cliff tax on estates valued between the threshold 611 million in 2022 and 105 of that amount 6415500 in 2022.

The maximum Federal tax rate is 40. The New York estate tax exemption equivalent increased from 593 million to 611 million effective January 1 2022 but continues to be phased out for New York taxable estates valued between 100 and 105 of the exemption amount with no exemption being available for taxable estates in excess of 105 of the exemption amount. It is anticipated to be a little over 6 million in 2022.

If you require a paper copy of the certificate email orptsstartaxnygov. Up to 25 cash back For deaths in 2021 New York taxes estates larger than 593 million. Any amount above that is subject to estate taxes that can be as high as 40.

The size of the estate tax exemption meant that a mere 01 of. Commencing January 1 2022 the New York State Estate Tax Exemption per person. The entire estate would be subject to New York estate tax because of the cliff.

The maximum estate tax rate in New York is 16 but other states with a 16 maximum estate tax apply the rate only to the estates value exceeding the states exemption. For people who pass away in 2022 the exemption amount. Ad Download Or Email Form ST-121 More Fillable Forms Register and Subscribe Now.

At a rate of 40 the federal estate tax bill would result in 3176 million. The information on this page is for the estates of individuals with dates of death on or after April 1 2014. New York estate tax update for 2022.

Posted on April 27 2022 by Luisa Rollenhagen. You can find all the details on tax rates in the Revenue Procedure 2021-45. In other states the estate would pay a tax based on a percentage of the excess amount.

Gifts made in the three 3 years prior to death are subject to claw-back and included in the calculation of the NYS gross estate. The 2022 STAR exemption amounts are now available online except for school districts in Nassau County which we will certify in May. 2 days agoWithout benefiting from the unused portion of Johns exemption the 1206 exemption for Ted in 2022 results in 794 million being subject to estate taxes.

In 2022 the law assesses no taxes on an individual taxable estate of less than 12000000. Although the top New York estate tax rate. Grow Your Legal Practice.

New Yorks estate tax law has a significantly lower threshold. Very few people understand how this works in practice. Despite the large Federal Estate Tax exclusion amount New York States estate tax exemption for 2021 is 593 million.

2022 New York State Estate Tax Exemption. The New York States estate tax exemption for 2022 is 6110000 million. Find out what these changes mean for you.

The New York estate tax exemption amount is currently 5930000 for 2021. The maximum NYS tax rate is 16. For people who pass away in 2022 the Federal exemption amount will be 1206000000.

The New York estate tax is a tax on the transfer of assets after someone dies. New York State still does not recognize portability. The estate tax exemption is adjusted for inflation every year.

Ad Get Access to the Largest Online Library of Legal Forms for Any State. Everyone with a NYS taxable estate in varying degrees. When you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount Federally or the basic exclusion amount in New York State.

Who does the Cliff affect. Lessening the New York estate tax impact. But what if his widow dies a year later in 2022 with a 7000000 estate and an applicable New York exclusion amount of only 6110000.

There will be no federal or state estate tax at the death of the first spouse due to the unlimited marital deduction. As of the date of this article the exact exclusion amount for 2022 has not been released. For couples the exclusion is now 2412 million.

Amount above NYS exemption. No portability in NYS. We posted the basic exclusion amount for dates of death on or after January 1 2022 through December 31 2022.

For individuals passing away in. Even if a deceaseds estate is not large enough to owe federal estate tax individuals may still owe an estate tax to the state of New York. Trusts and Estate Tax Rates of 2022.

Meanwhile transfers among spouses remain exempt from taxation due to the unlimited marital deduction. The IRS recently announced inflation adjustments for the 2022 tax year with Estate Tax rates and Trust tax. Generally when you die your estate is not subject to the federal estate tax if the value of your estate is less than the exemption amount.

The current New York estate tax exemption amount is 6110000 for 2022. New York is one of the states that administers their own NY estate tax and has a relatively low NY estate tax exemption amount. Only a small minority of families will have to pay estate taxes to the federal government after a loved one dies.

The estate tax rates in New York are not the highest among the eleven states imposing their own such tax but New Yorks estate tax bite is significant. In New York for the year 2022 a single persons estate is subject to tax beyond what New York. Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms.

In case the property value is 6 million there is a 70000 taxable overdue. In 2022 the New York estate tax exemption is 6110000 up from 593mm in 2021. New York Estate Tax.

The federal estate tax exemption for 2022 is 1206 million. In 2022 an individual can leave 1206 million to their heirs without paying any federal estate or gift tax. Under current law this number will remain until January 1 2023 at which point it will rise again with inflation.

The annual inflation adjustment for federal gifts inheritance and generation-skipping tax exemption has increased from 117 million in 2021 to 1206 million in 2022. New Yorks Estate Tax Rates.

New York Estate Tax Everything You Need To Know Smartasset

What Will Happen When The Gift And Estate Tax Exemption Gets Cut In Half

Generation Skipping Trust Gst What It Is And How It Works

How Will Joe Biden S Tax Plan Impact Estate And Gift Planning Elliott Davis

Do I Pay Taxes On Inheritance Of Savings Account

New Irs Requirements To Request Estate Closing Letter

Adler Adler New York State Estate Tax Rates

Eight Things You Need To Know About The Death Tax Before You Die

Opportunity Is Still Knocking Gift Tax And Estate Tax Exclusions Are Increasing In 2022 Pierrolaw

Life Insurance And Inheritance Tax Forbes Advisor Uk

It May Be Time To Start Worrying About The Estate Tax Published 2021 Estate Tax Capital Gains Tax How To Raise Money

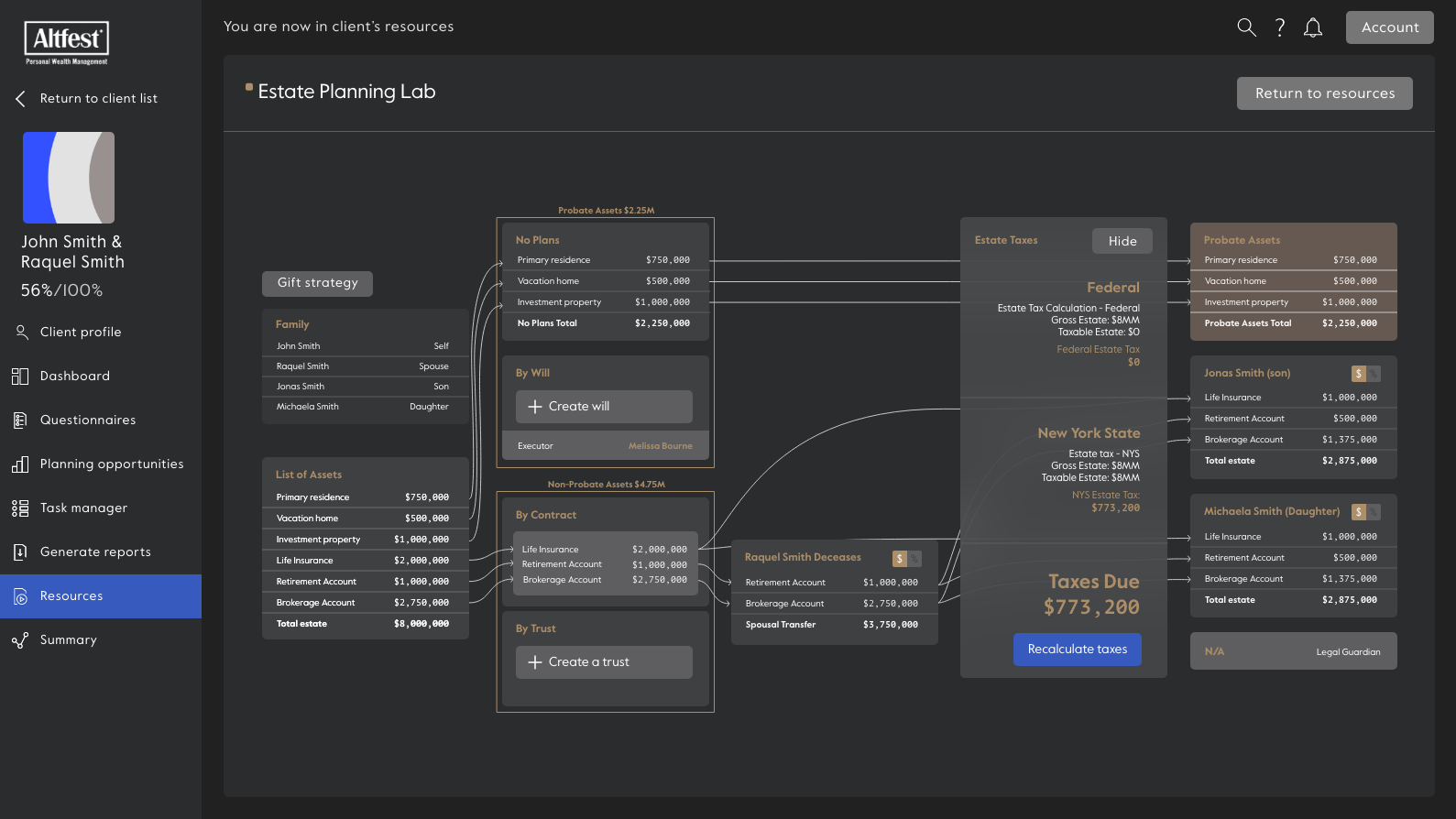

Planning Now For Greater Estate Tax Exposure Ny S Estate Tax Cliff Altfest

Connecticut Estate Tax Everything You Need To Know Smartasset

New York Estate Tax Everything You Need To Know Smartasset

Irs To Dispose Of Older Estate Tax Returns Wealth Management

Stronger Estate Tax Would Hit More Inheritances Under Democrats Plan

New York Estate Tax Everything You Need To Know Smartasset