r&d tax credit calculation uk

Divide the aggregate QREs by the. Calculate RD tax relief in under 3 minutes.

R D Tax Credit Calculation Examples Mpa

Company X made profits of 400000 for the year calculate the RD tax credit saving.

. The Research and Development Expenditure Credit is a tax credit it was 11 of your qualifying RD expenditure up to 31 December 2017. Just follow the simple steps below. It was increased to.

Steps to calculate the RD tax credit via the traditional method 2. Home RD Tax Credits Calculator. Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today.

Established in the US for over 8 years we provide specialist pension advice to UK Expats. Established in the US for over 8 years we provide specialist pension advice to UK Expats. Ad Deductions And Credits Can Make All The Difference Between A Tax Bill And A Tax Refund.

Ad Access Tax Forms. Our RD Tax Credit Calculator will give you a ball-park figure on how much RD Tax Relief you could receive from HMRC. Over the last 20 years RD Tax Credits have helped thousands of UK businesses to invest in RD improve.

Our RD tax credit calculator gives you an instant estimate of your potential. Guidance on this can be found on our Which RD scheme is right for my company page. RD tax credits a key ingredient to help UK businesses sustainability.

This figure may vary depending on your actual reported figures - our RD tax credit calculator is intended as a guide only Sample RD calculations. Add uplift to your. Learn More At AARP.

Estimate RD tax relief for your business. 6 Often Overlooked Tax Breaks You Wouldnt Want To Miss. This can be done for the current financial year and the 2 previous.

Supports Profit and Loss making. Im new to Claming. In the 2020-21 tax year.

The UK RD tax credit scheme offers UK companies a great opportunity to claim tax relief based on RD costs. RD Tax Credits Explained. Complete Edit or Print Tax Forms Instantly.

Ad Let Florin review your UK pension plan options to help you achieve your retirement goals. Total the QREs for the current tax year. The popular form of tax relief works by reducing innovative businesses liability to corporation tax or through making a direct payment to a company.

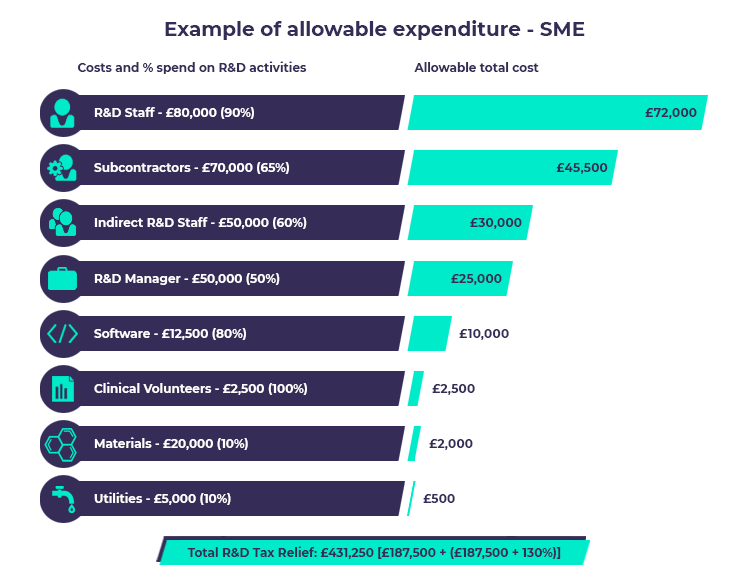

Ad Let Florin review your UK pension plan options to help you achieve your retirement goals. Under the SME scheme you can only claim 65 of the qualifying spend. RD Tax Credits Whether youre new to RD.

Determine aggregate QREs over a base period. If there is a 100000 payment to a subcontractor of which half is for RD activities the. Maximise your R.

Profit-making SME with 50000. The qualifying expenditure is 100000 thats already in accounts as expenditure. As a simple example well use an RD spend of 100000 for the purpose of this RD tax credit calculation and apply it to the following steps.

Select either an SME or Large company.

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credits Explained Are You Eligible What Projects Qualify

R D Tax Credits 20th September Ppt Download

R D Tax Credits Explained In 2022 What Are R D Tax Credits Who Is Eligible

What Increased Audit Scrutiny Means For Your Uk R D Tax Claims

What S The R D Tax Credit Program Overview Cti

R D Tax Credits 360 Research And Development

R D Tax Credits The Essential Guide 2020

Two Methods In Calculating For R D Tax Credits The Market Oracle

How To Enter Research And Development Claims

What Is The R D Tax Credit And Could Your Company Qualify

R D Tax Credits For Food Drink And Breweries Approved Accounting

R D Tax Credit Calculation Methods Adp

How Do You Claim R D Tax Credits

R D Tax Credits Calculator Free To Use No Sign Up Counting King

R D Tax Credit Calculation Examples Mpa

How To Calculate R D Tax Credits With Examples Kene Partners